EXCLUSIVE – BANGKOK BOILER ROOMS – THE MONEY TRAIL – HOW IT WAS LOST

IT COULD HAVE BEEN FOLLOWED ON A MOONLESS NIGHT – WAS THERE NO WILL?

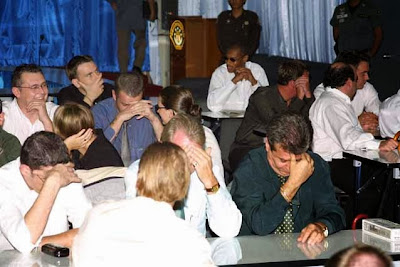

When Thai Police accompanied by Australian Federal Police and the FBI raided the offices of the Brinton Group in Bangkok City Tower way back in July 2001 the move was heralded as a breakthrough in the fight against international fraud – and in particular boiler rooms.

The Thai Security Exchange Commission charged the leaders with running illegal share trading businesses in a triumph of international police co-operation and officials of the Thai SEC even went to Australia where most of the victims of the latest boiler room scams were located to presumably gather information.

The victims were identified. The ringleaders were identified and astoundingly all the transactions had been detailed by a private ‘facilities’ company operating out of Hong Kong, which handled the boiler rooms’ incoming cash and transferred it to other accounts and even the personal accounts of the ring leaders.

It is estimated that the Brinton Group defrauded Australians out of US$400 million alone. But what actually happened was a far cry from a triumph of international police co-operation. The Thai courts fined and gave suspended sentences to the ring leaders in Bangkok. They did not even deport them whereas their minions, who operated the phones, and opened and closed deals had long since been kicked out of the country as undesirables (if only on a temporary basis).

Buck passing

|

| Can I take your order now sir? |

The Australian Feds gave up and the Australian Securities and Investment Commission, dropped their enquiry on the basis of difficulties dealing with crimes committed abroad.

There had been buck passing in Australia.

The AFP claimed it was up to individual state police to deal with the problem but individual state police forces claimed the matter was a Federal one.

Running Bangkok’s nightlife

And Bangkok’s boiler rooms continued to flourish to such an extent that today their hand is in a significant part of Thailand’s nightlife industry, encompassing, bars, restaurants, go-go venues, top nightclubs, and even a brothel.

| The sentences reported by ‘The Nation’ |

So what went wrong? Well the Thai courts were extremely lenient. I will not offer an explanation for that. And certainly the Thai police, despite goading, did not come up with the evidence which would have told the whole enormous size of the fraud. I am not going to offer an explanation for that either.

But assuming the Australian Federal Police, ASIC, and FBI knew there might be issues in Thailand where officials have been known to be susceptible to bribes, what result were they expecting if they did not intend to tie up all ends of this enquiry?

For on the day of the Brinton Group raid in Bangkok alarm bells began ringing in Hong Kong. Boiler room money was being channeled through the big banks Standard Chartered and the HSBC – (but Standard Chartered had closed one account after the Brinton Group had been flagged up by ASIC).

But one company in Hong Kong knew everything. Acceptor Professional Directors was a facilities company which had opened up companies offshore, particularly the Brinton Group of companies, and handled all the telegraphic transfers requested by the bosses in Bangkok. Not only that they provided ‘nominee directors’ for the companies!

“We were handling transfers of up to US$500,000 at a time on a regular basis which was being moved into the private accounts of the bosses, and into specific company accounts which they controlled.

“When the balloon went up and Brinton Group was raided in Bangkok Acceptor professional Directors was forced to hand over all this information to the Hong Kong Police’s Commercial Crime Bureau.

“When I say forced. They needed to do that to show they were not in any way mixed up in it,” said Adrian Cox an former employee at the company.

This was not exactly a secret kept from the Australian Police or even ASIC for that matter. The South China Morning Post ran a story stating the case in July 2001. just days after the raid.

Acceptor’s two leading directors were Frank Mullens, a former Price Waterhouse partner, and Robert Hinchcliffe, an accountant. Both are Australians. So the victims were Australian, the facilitators, were Australian, and even one of the ringleaders arrested in Bangkok was Australian.

| Crossing borders- creating solutions. Acceptors rebranded as Vistra |

Moreover, insisted Mr. Cox, treaties are in place between Australia and Hong Kong which would have made it easy for the Australian authorities to pick up the evidence from the Hong Kong Police with ease.

But despite urgent requests to the authorities to talk to officials in Hong Kong there is no evidence to suggest the Australian authorities attempted to get that vital information.

| A Brinton script. This dealer was pretending he was in Tokyo |

What added salt to the wounds of the victims was that the Hong Kong authorities froze the Brinton accounts in Hong Kong pending their own investigation. Their own investigation subsequently failed to unearth any Hong Kong victims and was subsequently terminated – and the funds were unfrozen and handed back.

More than a decade on the Australian victims are still trying to get their money back – thought at least three are understood to have committed suicide in the meantime.

Adrian Cox, became a Head of Compliance at Acceptor Professional Directors in Hong Kong, but he fell out with the company. He says, as Head of Compliance he did not want to be held responsible for some of the less than transparent deals which were being channeled through his staff, which he would not approve. In fact he was terminated. but the company has since paid out $1 million in compensation to him.

In his complaint to the Australian Senate Standing Committee on Economics he revealed an internal memo between ‘Acceptor’ directors which stated: ‘The basic picture looks ugly. Probably over US$1OOM has passed through key companies over the last 2-3 years with large chunks going to accounts of either companies belonging to the principals or to the principals themselves.”

For those unaware of how boiler rooms work I am also including Cox’s summary.

“Firstly, telephone calls were made to Australian Investors from Thailand with alleged false and/or misleading statements made by the callers in relation to the investments they were selling shares in.

Brochures and prospectuses were also allegedly sent to the victims as part of the fraud to convince investors these were real companies they were investing in.

“These telephone calls constituting alleged false and/or misleading representations would appear to have been in breach of various sections of the ASIC Act 2001.

Secondly, following a “successful” telephone call by the alleged fraudsters, investors would then transfer money out of their Australian banks accounts to the Hong Kong bank accounts in names of the companies the investors were told they were investing in.

However these were not real companies in the sense that investors were actually buying shares in them. They were merely companies set up with Acceptor by the principals of the Brinton Group and were established with names which were identical to USA based companies which the Brinton Group were telling Investors they were investing in.

These companies were actually owned by key executives from the Brinton Group and were incorporated in places like the BVI and Samoa etc., however the investors did not know this.

| The 2001 raid on Brinton in Bangkok City Tower – Man bottom right in jacket is FBI |

At this stage, not only is it possible that further breaches of the ASIC Act were occurring, but it would also appear that the various Criminal Codes of the States where some of the investors were resident were also being breached by way of offences relating to theft. fraud, obtaining property by deception, receiving property stolen or fraudulently obtained etc.

It would also appear that Commonwealth Acts. being the Crimes Act 1914 and the Criminal Code Act 1995, were also being breached in relation to the same kinds of offences at this stage.

| An ‘Acceptors’ internal memo ‘The basic picture looks ugly’ |

Finally, once the money had reached Hong Kong, the principals of the Brinton Group (being the same people who had been arrested in Bangkok) would instruct Acceptor’s staff to make transfers of the investor money which were not in accordance with the buying of shares or investments in companies on behalf of the investors. (They instructed the staff to transfer the money to other companies they personally owned or even directly to their own personal bank accounts)

At this final stage, if it wasn’t already the case that the various State and Commonwealth criminal codes mentioned above had been breached, then they certainly had been by this time”

He added:

“I reviewed the bank statements”“ Since I worked for the company which provided services to the Brinton Group and also reviewed all the bank statements for it and its associated companies, and since I know that the Hong Kong police took all this information for the purposes of its own investigation in August 2001, then I know that evidence which would appear to have enabled a successful prosecution by ASIC did exist in Hong Kong with the Hong Kong police.

However it seems from ASIC’S response that such evidence was never considered by ASIC in its investigation and for the purposes of considering a prosecution.”

ASIC had responded to the Australian Brinton Group Recovery Association (ABGRA) which had been set up to represent the victims. They had taken legal advice, they said, and they concluded they would not be able to bring successful prosecutions.

| Part of ASIC’s response. The full answer can be found on the Australia Parliament House website |

ASIC triumphed that it had however successfully taken a prosecution against Paul Richard Bell, who had been arrested in Australia. Bell was involved with the Brinton connected International Asset Management Group. He is a key boiler room figure.

That prosecution can hardly be described as a triumph for ASIC. He was fined a mere Aus$12,000 and given a six month suspended sentence. He was also bound over to be of good behaviour. Knowing the figures involved it was hardly worth the prosecution.

He’s back in Thailand. He joined, with his son, the Optimists Club of Pattaya, started by American Drew Noyes, but which was later disowned by Optimists International.

This is no consolation for a Ian Painter an Australian forensic accountant, who himself was a Brinton victim, and who for years has been chasing the Brinton cash for ABGRA.

Mr. Painter, from South Australia, told the Senate Standing Committee

“If funds were sent to supposedly reputable banks in Hong Kong who operate with many branches in Australia and who are subject to money laundering provisions, then why are Australian authorities unable to co-operate with their Hong Kong counterparts in the supervision and pursuit of money laundering activities when this has been identified?

“Specific accounts with these banks have been identified and representations made to the Hong Kong police and the Hong Kong Monetary Authority, including representations by the Acceptor Group who were responsible for transferring the funds into accounts under the principals of the Brinton Group and have details of the ownership of each of the bank accounts used to fleece funds from Australian victims.”

On behalf of the Australian victims ABRA has been in regular touch with the former Brinton operators in Bangkok – the last conversation being as recent as two weeks ago. At one stage, Brinton offered US$1.3m. Some monies have been recovered. Negotiations continue.

“I have been to Bangkok but I will not be going again. I would be a dead man,” said one of the Australian investigators. The only thing that concerns these them is their liberty or restrictions on travel.

“The fact is its known where the accounts were, what was in them, and where the money transferred. Its quite clear that the operators of those accounts are the guilty parties. What Australia needs is a special force dedicated to bringing international fraudsters to account.

“ASIC have said that they cannot do anything about the Brinton companies as they are not registered with ASIC. Its a bit like saying you cannot do someone for murder because his gun was not licensed”.

Where boiler rooms are concerned the US SEC is much more pro-active than the British Financial Conduct Authority or ASIC. But the Brinton Group, who were aided in the structuring of their companies by a New York based lawyer were careful not to target the United States.

There is no consolation either for victims of the Drover-Home Group, run by Australians, who took Australians in Queensland for over US$30 million.

Drover-Home were also clients of Acceptors Professional Directors, who by then had helped set up over 100 offshore businesses for boiler rooms. But Drover-Home operated a Ponzi schemes, according to complaints logged with the Senate Committee. They gave false high returns claiming to have made it on the money markets in London, but were in fact paying old clients out of fees from new clients.

Once again the cash flowed into Hong Kong and had enquiries been made there ASIC would have seen where it went, claims Cox.

Meanwhile of course thousand of expatriates across south east Asia have now lost their live savings in schemes put up by the LM Investment group in Australia which again appears to have been a Ponzi scheme.

When the matter was investigated by ABC TV’s ‘Four Corners’ – ABC quoted the chairman of the Australian Securities and Investments Commission (ASIC), Greg Medcraft saying:

“I think that that is quite interesting … thank you for the information. That is something that I wasn’t aware of it and it’s something that we will have a closer look at.”

Comment:

Hong Kong prides itself as being a money capital of good reputation – yet officials cannot co-operate fully with international police forces – two of which, the British and Australian, were the creators of their police force?

Once again global policing does not function along the lines claimed.

Rather than being pro-active, say critics of ASIC, and moving against international fraudsters, it is doing little more than attempting to close the stable door after the horse has bolted.

But ASIC is not alone- victims of boiler room fraud are worldwide.

Britain’s financial law enforcement agents are aware of the boiler rooms operating in Bangkok. They have lists of British victims but actual interdiction remains on their back burner.

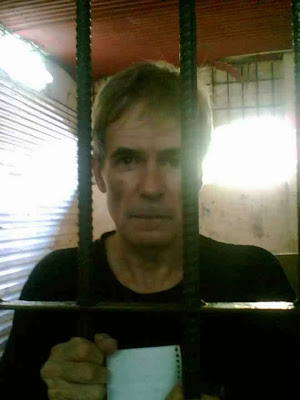

So high are the stakes that boiler room operators themselves are the subject of kidnap and extortion. Three policeman and two boiler room employees were later jailed for the kidnap and attempted extortion of this boiler room boss on the right. The US Embassy aided in the arrests.

Foreign police agencies in Bangkok have of course been hampered by the fact a top army general, a very well known politician, and senior police, are on file as aiding and abetting the operators, one of whom has married into the establishment.

Boiler rooms prefer to use the big banks to receive the initial payments from punters – then they quickly transfer the cash into private accounts. So in almost every major case they have seen the money pass through them. Scores of clear cases of money laundering were detected.

But then if HSBC can become the bank of choice for the Columbian Drugs Cartels, can the Brinton victims be so surprised?

Source: Australian Parliament House – ASIC – Submissions

.jpg)

.jpg)